CRUISE VESSELS TAX (ΤΕ.ΠΑ.Η.) FORM

You can download here the calculation and payment form of the tax on recreational and daily cruise vessels – LAW 4211/2013 (OG 256 A)

MORE INFO ABOUT THE CRUISE VESSELS TAX

The Greek Marinas Association has issued an announcement regarding the new legislation and the procedures yacht owners must take.

Information on e-Register and Fee for Pleasure Boats and Day Cruise Ships (TE.PA.H.)

We would like to inform you about the obligation to register ships in the electronic Ships’ Register ( Ships e-Register) and the obligation to pay the TE.PA.H.

1) Please note that an obligation exists to register, in the electronic Ships’ Register, which is in partial operation as of 15-11-2018, private pleasure boats sailing under the Greek flag, professional pleasure boats, regardless of their flag, and professional tourism day cruise ships. The process of registering in the electronic Ships’ Register is provided for in detail in POL 1209/12-11-2018 (Government Gazette 5092/B/14-11-2018).

2) The obligation to pay the TE.PA.H [in accordance with Article 13 of Law 4211/2013 and the JMD of 7-11-2018 of the Ministries of Finance and Shipping & Island Policy (POL 1210/18, Government Gazette 5170/B/16-11-2018)] shall apply to private and professional pleasure boats and professional tourism day cruise ships that are greater than 7 meters in length for each month they remain within Greek territorial waters, regardless of their flag.

According to POL 1210/18, the shipowner or the legal representative are jointly and severally liable for payment of the TE.PA.H for the professional ships and, for private pleasure ships, the shipowner or the occupier or user are liable.

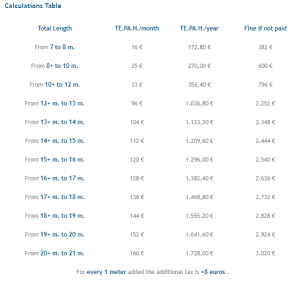

The TE.PA.H is calculated on the basis of the length of the ship (Article 13 (3) of Law 4211/13.) The calculation is shown in the following table:

| Length of ship | Fee |

| From 7 to 8 meters | 16 euros per month |

| From 8 to 10 meters | 25 euros per month |

| From 10 to 12 meters | 33 euros per month |

| 12 meter and more | 8 euros per meter per month |

For payment of the TE.PA.H, an electronic payment code (e-Paravolo) and payment via bank as well as transfer via SEPA is required. If issuing of an electronic payment code is not possible, payment shall be made to any Tax Office or Port or Customs Authority.

Reductions/discounts in the above fee are provided as follows (Article 5 of POL 1210/18):

(a) for professional pleasure ships greater than 12 meters in length and professional tourism pleasure boats, a reduction of 25% (conditional upon dedicated professional use)

(b) a reduction of 20% if the (professional or private) ships enter and remain in ports within Greek territory during the current calendar year and provided they pay an advance lump sum payment for the fee for the entire calendar year. A reduction of 20% shall be granted to commercial ships in addition to the reduction of 25%.

(c) a 10% discount in the event of a lump sum advance payment of the fee for Pleasure Boats and Day Cruise Ship for 12 months, provided that the lump-sum payment is made in January of the current calendar year, or in December of the previous year to which it relates.

In Article 6 of POL 1210/18 exemptions are provided for with regard to payment of the TE.PA.H for the following ships:

(a) Decommissioned or confiscated vessels, for the period of their decommissioning or confiscation.

(b) Ships characterised as “traditional” ships

(c) Ships that are stationary (Out of Use).

It should be noted that, in accordance with Article 9 of POL 1210/18, for ships already located within Greek territorial waters, the TE.PA.H shall be paid within 10 days following publication of the POL in the Government Gazette (in other words up to 26-11-2018).